Cbec

- All

- News

- Videos

-

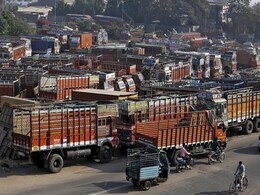

GST: E-Way Bill Roll-Out Deferred Owing To Technical Glitches

- Monday February 5, 2018

- Business | Press Trust of India

GST provision requiring transporters to carry an electronic waybill or e-way bill when moving goods between states was to be implemented from today to check rampant tax evasion

-

www.ndtv.com/business

www.ndtv.com/business

-

Special GST Session By CBEC To Address Taxpayers' Queries

- Saturday November 25, 2017

- Business | NDTV Profit Team

The hour-long session on GST will be organized on both days of the weekend between 4 pm to 5 pm. The venue is hall number 18 of Pragati Maidan in New Delhi.

-

www.ndtv.com/business

www.ndtv.com/business

-

Firms Don't Need To Deduct GST On Advances Received For Goods Supply

- Thursday November 16, 2017

- Business | Press Trust of India

The government has exempted businesses from deducting GST on advances received for supplying goods in future

-

www.ndtv.com/business

www.ndtv.com/business

-

Tax Authorities To Verify GST Transition Credit Claims Of 162 Firms

- Friday September 15, 2017

- Business | Press Trust of India

Under GST transition rules, traders and retailers are allowed to claim credit of 60% of taxes paid earlier against the new GST rates.

-

www.ndtv.com/business

www.ndtv.com/business

-

Deadline For Filing First GST Returns, Payments Extended

- Saturday August 19, 2017

- Business | Edited by Prashun Talukdar

"Since it is the first tax Return to be filed under GST, the tax payers and the tax practitioners have requested for few more days to file their Return," CBEC said in a notification.

-

www.ndtv.com/business

www.ndtv.com/business

-

GST Rates For Hybrid Vehicles May Be Reduced

- Saturday July 22, 2017

- Written by Cyrus Dhabhar

On July 1, 2017, the Government of India rolled out the Goods and Services Tax reforms. GST, one of the biggest economic reforms in recent Indian history had several implications with certain products and services becoming considerably more expensive as compared to earlier. The auto industry though rejoiced as the new country wide rates made it eas...

-

www.carandbike.com

www.carandbike.com

-

GST Composition Scheme: Who Can Opt, The Rates Applicable And More

- Wednesday July 19, 2017

- India News | Edited by Sandeep Singh

Under GST, trader, manufacturer and restaurants are not required to register or pay tax in case of annual turnover below Rs 20 lakh.

-

www.ndtv.com

www.ndtv.com

-

GST Rates: Here's An App To Find Out Taxes On Goods, Services

- Thursday July 13, 2017

- India News | NDTV Profit Team

GST Rate Finder app enables users to find out the new tax rates on several goods and services and cross check their bills on the go.

-

www.ndtv.com

www.ndtv.com

-

GST: What Details Need To Be Furnished To Fill GSTR-1 Form?

- Tuesday July 11, 2017

- India News | NDTV Profit Team

The Central Board of Excise and Customs has time and again come out with answers to several frequently asked questions pertaining to many segments.

-

www.ndtv.com

www.ndtv.com

-

GST FAQs: Form GSTR-1, Composition Scheme And More

- Friday July 7, 2017

- India News | NDTV Profit Team

Form GSTR-1 is to be filled for outward supplies made by the trader (made in the month for which return is being filed) by the 10th of the next month.

-

www.ndtv.com

www.ndtv.com

-

Cheaper After GST: Common Use Items That Attract Less Taxes Now

- Tuesday July 4, 2017

- India News | NDTV Profit Team

The Central Board of Excise and Customs has come out with a list of common use items that will attract lower taxes under the new indirect tax regime compared to pre-GST tax incidence.

-

www.ndtv.com

www.ndtv.com

-

GST: E-Way Bill Roll-Out Deferred Owing To Technical Glitches

- Monday February 5, 2018

- Business | Press Trust of India

GST provision requiring transporters to carry an electronic waybill or e-way bill when moving goods between states was to be implemented from today to check rampant tax evasion

-

www.ndtv.com/business

www.ndtv.com/business

-

Special GST Session By CBEC To Address Taxpayers' Queries

- Saturday November 25, 2017

- Business | NDTV Profit Team

The hour-long session on GST will be organized on both days of the weekend between 4 pm to 5 pm. The venue is hall number 18 of Pragati Maidan in New Delhi.

-

www.ndtv.com/business

www.ndtv.com/business

-

Firms Don't Need To Deduct GST On Advances Received For Goods Supply

- Thursday November 16, 2017

- Business | Press Trust of India

The government has exempted businesses from deducting GST on advances received for supplying goods in future

-

www.ndtv.com/business

www.ndtv.com/business

-

Tax Authorities To Verify GST Transition Credit Claims Of 162 Firms

- Friday September 15, 2017

- Business | Press Trust of India

Under GST transition rules, traders and retailers are allowed to claim credit of 60% of taxes paid earlier against the new GST rates.

-

www.ndtv.com/business

www.ndtv.com/business

-

Deadline For Filing First GST Returns, Payments Extended

- Saturday August 19, 2017

- Business | Edited by Prashun Talukdar

"Since it is the first tax Return to be filed under GST, the tax payers and the tax practitioners have requested for few more days to file their Return," CBEC said in a notification.

-

www.ndtv.com/business

www.ndtv.com/business

-

GST Rates For Hybrid Vehicles May Be Reduced

- Saturday July 22, 2017

- Written by Cyrus Dhabhar

On July 1, 2017, the Government of India rolled out the Goods and Services Tax reforms. GST, one of the biggest economic reforms in recent Indian history had several implications with certain products and services becoming considerably more expensive as compared to earlier. The auto industry though rejoiced as the new country wide rates made it eas...

-

www.carandbike.com

www.carandbike.com

-

GST Composition Scheme: Who Can Opt, The Rates Applicable And More

- Wednesday July 19, 2017

- India News | Edited by Sandeep Singh

Under GST, trader, manufacturer and restaurants are not required to register or pay tax in case of annual turnover below Rs 20 lakh.

-

www.ndtv.com

www.ndtv.com

-

GST Rates: Here's An App To Find Out Taxes On Goods, Services

- Thursday July 13, 2017

- India News | NDTV Profit Team

GST Rate Finder app enables users to find out the new tax rates on several goods and services and cross check their bills on the go.

-

www.ndtv.com

www.ndtv.com

-

GST: What Details Need To Be Furnished To Fill GSTR-1 Form?

- Tuesday July 11, 2017

- India News | NDTV Profit Team

The Central Board of Excise and Customs has time and again come out with answers to several frequently asked questions pertaining to many segments.

-

www.ndtv.com

www.ndtv.com

-

GST FAQs: Form GSTR-1, Composition Scheme And More

- Friday July 7, 2017

- India News | NDTV Profit Team

Form GSTR-1 is to be filled for outward supplies made by the trader (made in the month for which return is being filed) by the 10th of the next month.

-

www.ndtv.com

www.ndtv.com

-

Cheaper After GST: Common Use Items That Attract Less Taxes Now

- Tuesday July 4, 2017

- India News | NDTV Profit Team

The Central Board of Excise and Customs has come out with a list of common use items that will attract lower taxes under the new indirect tax regime compared to pre-GST tax incidence.

-

www.ndtv.com

www.ndtv.com